In 1945, then Chairman of the New York Federal Reserve Bank of New York, Beardsley Ruml, made a speech to the American Bar Association entitled, Taxes for Revenue are Obsolete. According to Ruml, and understood by those familiar with Austrian Economics, the primary purpose of the federal income tax is to redistribute income and wealth; and “in subsidizing or penalizing various industries and economic groups.”

Our Founders understood this; that is why we had no income tax while they were alive; and no permanent income tax until the passage of the 16th Amendment in 1913, which gave Congress the authority to “lay and collect taxes on incomes, from whatever source derived.” As Ruml explained, since the U.S. government had a central bank, i.e., the Federal Reserve; and, since the U.S. dollar, for domestic purposes, was not convertible into gold or any other commodity, the U.S. government no longer had to enter “the domestic money market” to pay its bills or fund its operations.

Unlike the fifty States, which cannot print money, the federal government has unlimited access to the funds it needs and therefore, can do whatever it so desires. The real purpose of the federal income tax, as explained by Bob Livingston, “is to regulate consumption, control behavior, control and redistribute wealth, and compile dossiers on all citizens.

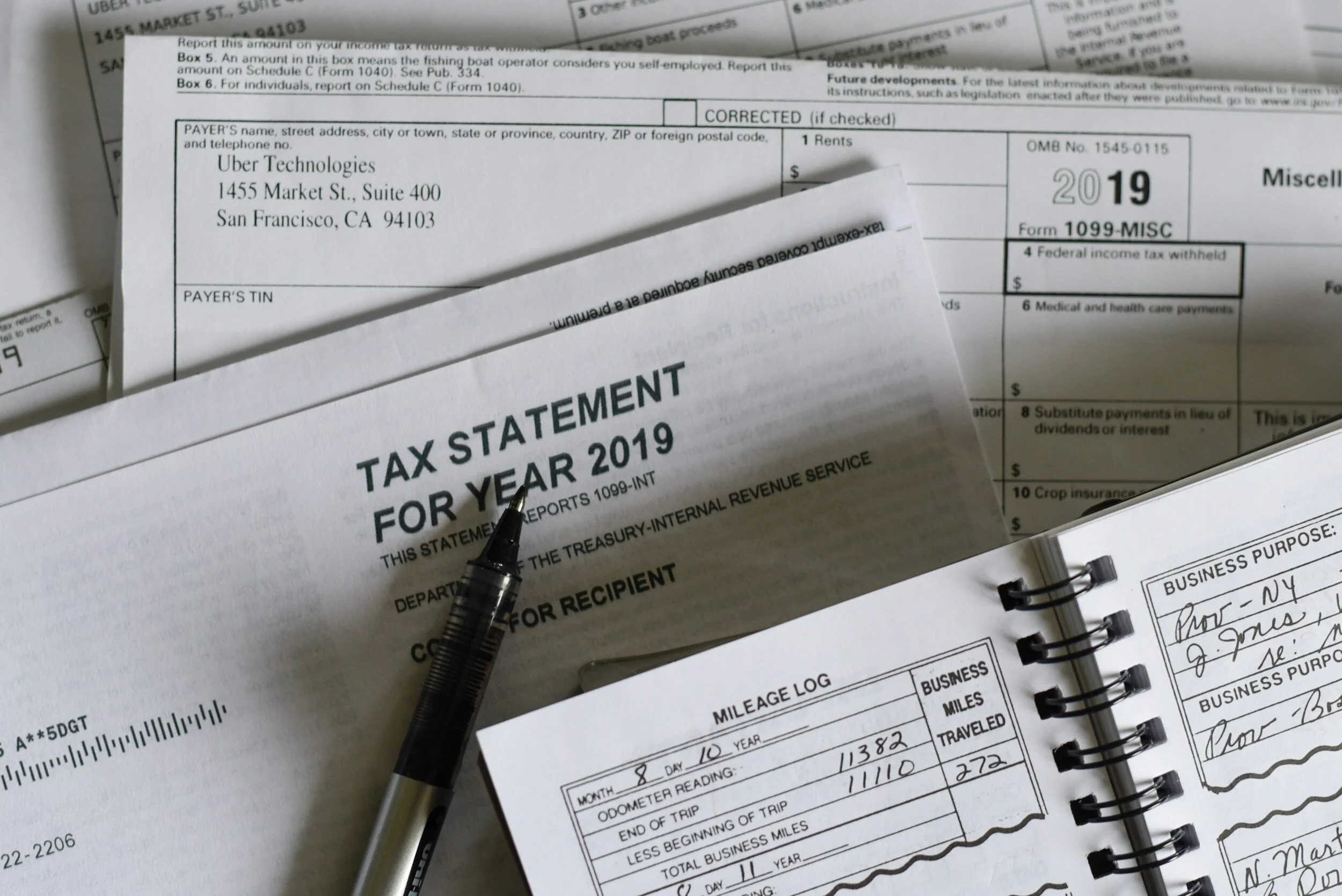

The Form 1040 is the “taxpayer’s dossier.” We no longer live in “the land of the free.” The passage of the 16th Amendment in 1913, which was contrary to the Founding generation’s principles of natural rights “to Life, Liberty and the Pursuit of Happiness,” violated our individual rights to ourselves, to our labor, and to our property. With the ratification of the 13th Amendment on December 6, 1865, we abolished slavery.

Forty-eight years later, we instituted slavery of the entire population with an unconstitutional direct tax on labor. As stated by Frank Chodorov in 1954, “We cannot restore traditional American freedom unless we limit the government’s power to tax. No tinkering with this, that, or the other law will stop the trend toward socialism. We must repeal the Sixteenth Amendment.”

The more Americans begin to understand the fraud associated with the income tax, the closer we come to abolishing the IRS, replacing the income tax with a consumption tax, and repealing the 16th Amendment, limiting the power of the U.S. government to tax and enslave us.

Dum Spiro Spero—While I breathe, I hope.

Slainte mhath,

Robert (Mike) G. Beard Jr., C.P.A., C.G.M.A., J.D., LL.M.

PS: Please go to our website and sign our petition to Abolish the IRS, Abolish IRS — Jeffersonian Group | Financial Planning & independence.